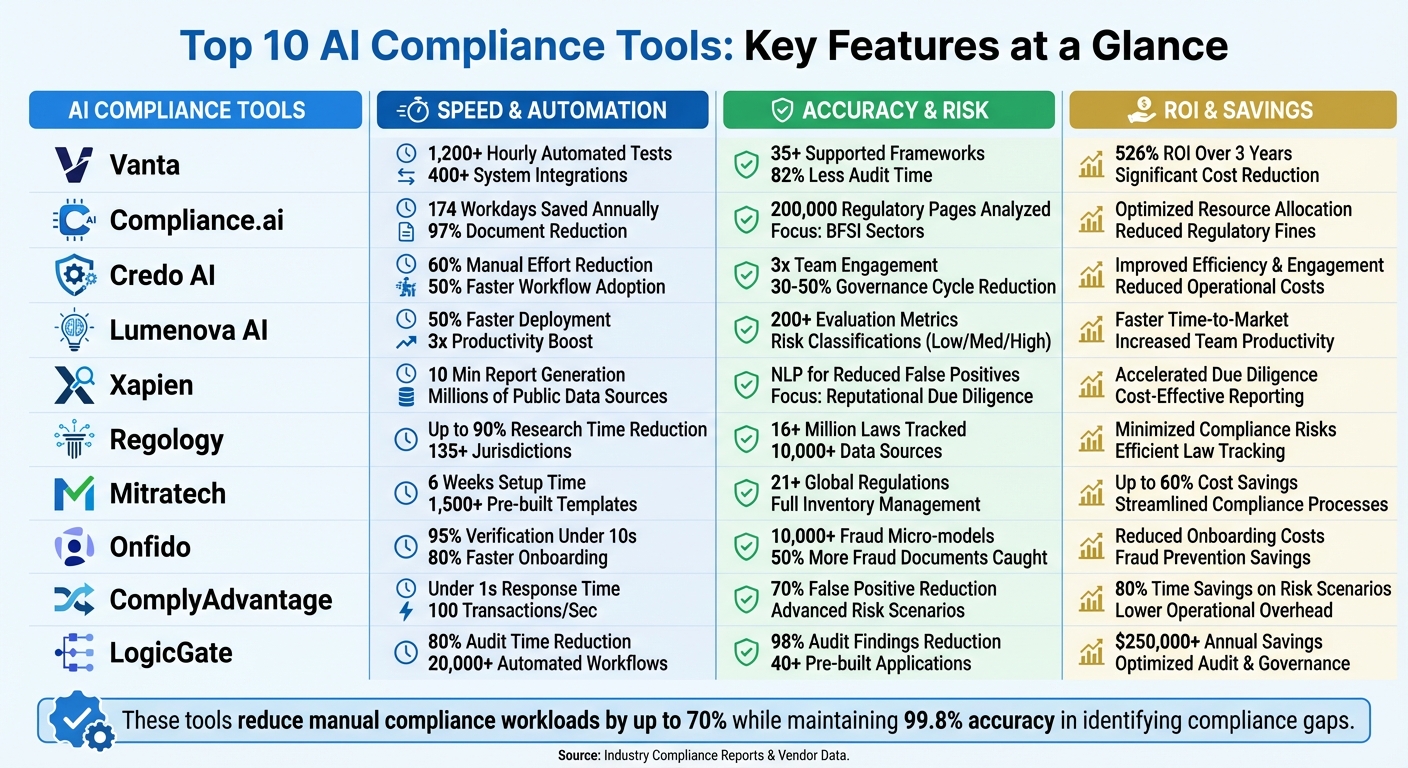

Top 10 AI Compliance Tools for Risk Assessment

Compare 10 leading AI compliance tools that automate risk assessments, provide real-time alerts, and track regulatory changes for enterprise teams.

Navigating compliance in today’s regulatory landscape is challenging. From GDPR to the EU AI Act, manual processes no longer suffice. AI compliance tools are transforming risk management, automating tasks, reducing false positives, and ensuring real-time regulatory tracking. Below are the top 10 tools reshaping compliance workflows:

- Vanta: Automates 1,200+ hourly tests, integrates with 400+ systems, and supports 35+ frameworks.

- Compliance.ai: Analyzes U.S. federal regulations, offers customizable alerts, and slashes document review time.

- Credo AI: Centralized AI registry with risk scoring and Policy Packs for global compliance.

- Lumenova AI: Evaluates AI models using 200+ metrics, assigns Trust Scores, and supports key frameworks.

- Xapien: Conducts due diligence in minutes using NLP to analyze public data and reduce false positives.

- Regology: Tracks over 16M laws across 135+ jurisdictions with a Smart Law Library.

- Mitratech: Predictive analytics and pre-built templates for faster risk assessments.

- Onfido: Fraud detection with 10,000+ micro-models, biometric verification in seconds.

- ComplyAdvantage: Real-time sanctions monitoring and dynamic risk scoring for financial transactions.

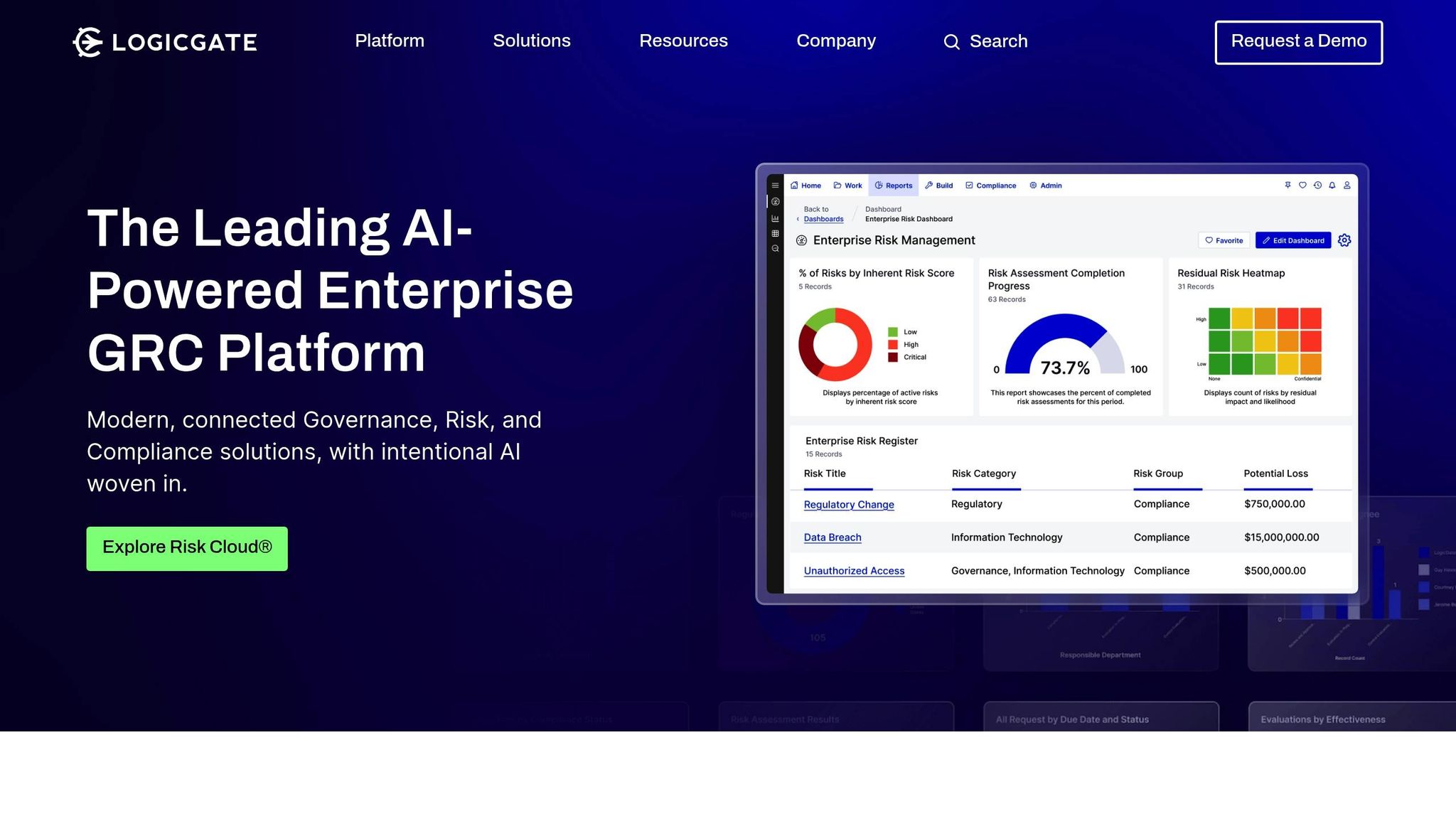

- LogicGate: No-code platform with Risk Cloud® to quantify risks in dollar terms.

These tools streamline compliance, cut manual workloads by up to 70%, and improve accuracy in identifying risks. Whether your focus is AI governance, financial regulations, or global compliance, these solutions provide tailored capabilities to meet your needs.

Top 10 AI Compliance Tools Feature Comparison Chart

[AI Series] Building an AI Tool for Financial Compliance With Mamal Amini

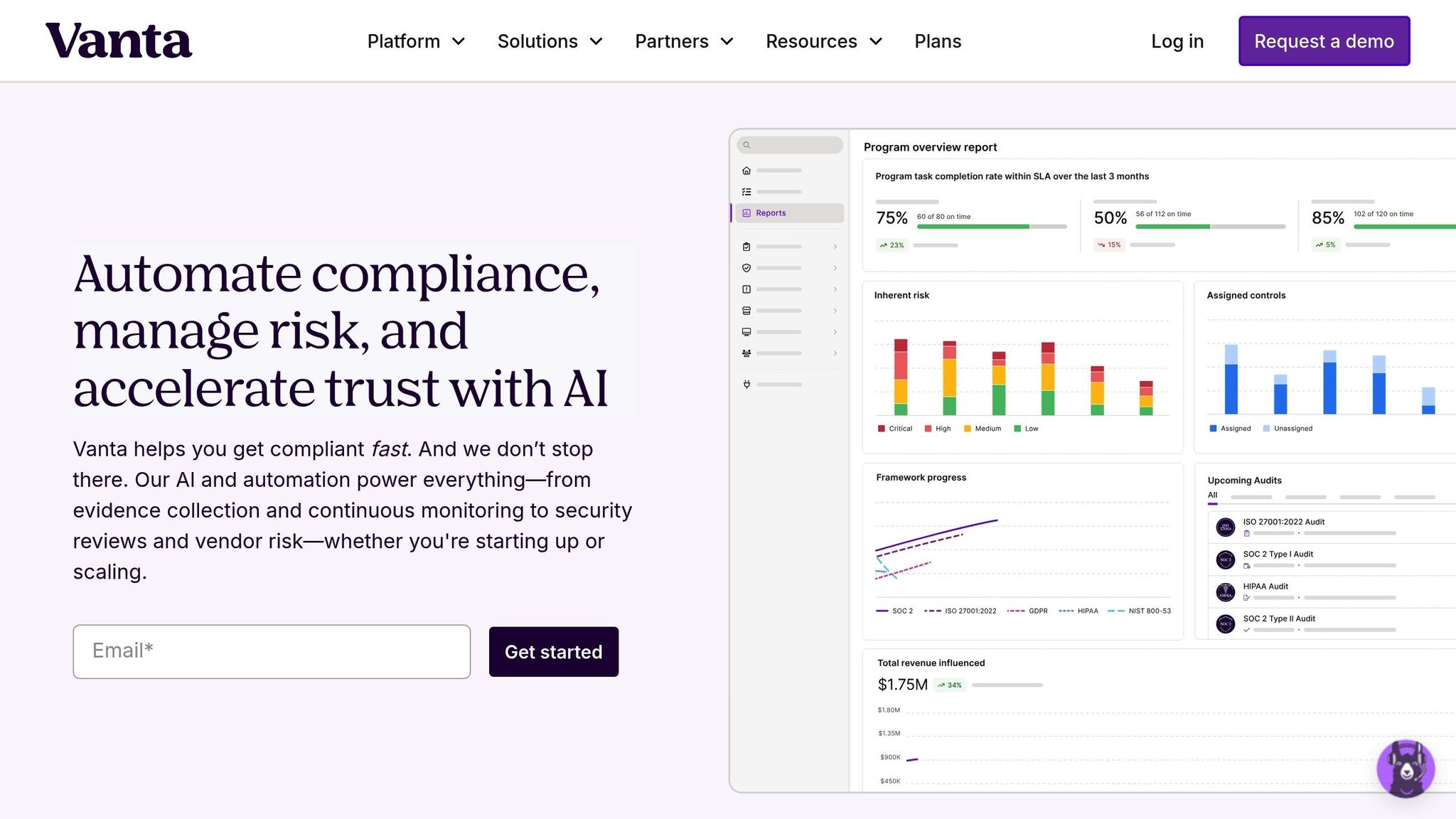

1. Vanta

Vanta is a platform designed for continuous compliance monitoring, running over 1,200 automated hourly tests across your entire infrastructure. It seamlessly integrates with 400+ systems, ensuring constant oversight of your controls.

Real-time alerts for compliance risks

The Vanta AI Agent works proactively by scanning your environment to spot potential compliance issues before they can lead to audit failures. It flags risks like terminated employee accounts or unauthorized departmental changes. For vendor management, it keeps an eye on third-party attack surfaces, sending instant alerts when new threats arise. It also identifies policy drift, where documented policies no longer align with system practices, such as SLA mismatches, and verifies evidence against audit requirements in real time.

"The Vanta AI Agent complements my team's expertise by filling in knowledge gaps, helping us learn faster, and double-checking critical information - ultimately saving us 12 hours weekly." – Anne Simpson, Head of Privacy, Security & Compliance, Databook

These real-time alerts pave the way for Vanta's robust risk scoring and prioritization tools.

Risk scoring and prioritization

Vanta gives you the flexibility to tailor risk scoring dimensions and terminology to fit your internal workflows. It evaluates both inherent and residual risks, offering insights into the effectiveness of your mitigation strategies. With risk heatmaps and trend reports, stakeholders gain a clear understanding of the most pressing risk areas. The platform also includes a library of over 100 common risk scenarios, complete with suggested control mappings. To streamline remediation, the AI Agent provides personalized code snippets for tools like Terraform and AWS CLI, helping development teams resolve security issues up to 45% faster.

Regulatory tracking and updates

On top of its detailed risk assessments, Vanta actively monitors regulatory changes. It supports 35+ compliance frameworks, including SOC 2, ISO 27001, HIPAA, and emerging AI standards like ISO 42001, NIST AI RMF, and the EU AI Act. Monthly updates introduce new frameworks and expand regulatory support. The AI Agent automatically maps custom controls to its library of automated tests, pinpointing gaps in your compliance program. Companies using Vanta report spending 82% less time on framework and attestation-related audits.

Pricing tiers and scalability for enterprises

Vanta offers four pricing tiers to suit different needs:

- Essentials: Covers one compliance framework and includes basic AI features.

- Plus: Adds enhanced AI functionality, access management, and 25 automated questionnaires annually.

- Professional: Includes comprehensive risk management tools, customization options, and 144 questionnaires per year.

- Enterprise: Delivers a fully customizable solution with workspaces and multiple risk registers.

The platform proves its value quickly, paying for itself within 3 months and delivering a 526% ROI over three years. Compliance teams using Vanta see a 129% boost in productivity, and 91% of AI Agent users report improved audit readiness. These flexible pricing options highlight Vanta's focus on delivering efficient, cost-effective compliance solutions in real time.

2. Compliance.ai

Compliance.ai is specifically designed for the BFSI (Banking, Financial Services, and Insurance) sectors, utilizing machine learning models to keep a close eye on global regulatory landscapes. It processes nearly 200,000 pages of U.S. federal regulations, offering a comprehensive solution for compliance teams.

Real-Time Alerts for Compliance Risks

This platform provides unlimited, customizable alerts tailored to specific agencies, topics, or regulatory requirements. Whenever new enforcement actions are issued, teams receive immediate notifications, complete with details such as respondents and penalty amounts. For example, in early 2026, over a 30-day period, the system tracked 1,558 enforcement actions in the U.S., including SEC actions totaling $37,812,859. It also helps managers stay on top of delayed internal tasks by sending timely reminders.

"Most solutions in the market today are not scalable and still rely on a pull of regulatory content across a multitude of sources, rather than a 'push' of information from a single, reliable source. This is the key value Compliance.ai delivers for banks." – Richard Dupree, SVP, IHC Group Operational Risk Manager, Bank of the West

In addition to real-time alerts, the platform streamlines document review. It reduces the number of documents legal and compliance teams need to analyze annually from an average of 25,537 to just 585. To highlight its efficiency, in a single week, it processed 11,906 new documents, demonstrating its ability to manage the immense volume of regulatory activity.

Regulatory Tracking and Updates

Compliance.ai uses a patented Expert-in-the-Loop (EITL) approach, combining AI-driven analysis with human expertise. This method enhances regulatory content and identifies specific obligations. The system automatically scans, tags, and organizes documents with metadata, such as agency, jurisdiction, type, obligations, and impacted controls. These features create a searchable library that connects regulatory changes directly to internal policies.

"Compliance.ai's platform is incredibly helpful for contextualizing the vast amount of daily regulatory updates into actionable insights, and customizing my content feed, so I have focused and timely information on all the regulatory changes relevant to my business." – Ileana Falticeni, Chief Legal Officer, Quantcast

By automating tracking and identification tasks, the platform saves compliance teams an average of 174 workdays annually.

Pricing Tiers and Scalability for Enterprises

Compliance.ai offers a range of pricing plans to suit different organizational needs. The Pro edition includes features like the RCM Command Center, personalized dashboards, custom alerts, and an enforcement tracker. The Team edition adds functionality for automated task assignments, repeatable processes, workflow management, and certified audit reports. For larger organizations, the Enterprise edition introduces "Bring Your Own Content" (BYOC) capabilities, allowing teams to manage internal policies alongside regulatory updates. It also integrates seamlessly with document management systems such as SharePoint and Archer. The Developer edition takes it further, offering API access to enhanced regulatory content and API-based filtering.

Additional features, such as auto-translation, global regulatory content, and enforcement tracking, are available as add-ons. To help organizations estimate their potential savings, Compliance.ai provides a Savings Calculator on its website, which factors in team size and workload.

3. Credo AI

Credo AI, highlighted as a Leader in Forrester Wave™: AI Governance Solutions, Q3 2025, is a governance platform built for enterprise-level AI deployments. It supports both traditional machine learning models and autonomous systems, making it especially suited for regulated industries like financial services, healthcare, and government agencies.

Risk Scoring and Prioritization

Credo AI employs a centralized registry to capture AI metadata, helping organizations prioritize projects based on factors like revenue potential, impact, and risk. Its Risk Center provides visual dashboards that allow executives to monitor AI risks and benefits across teams, enabling them to focus on the most critical governance areas. For autonomous systems, the platform uses autonomy classifications and risk templates to identify behaviors or deployment drifts that could violate internal policies.

"The AI Agent Registry is your control center for agentic AI. Track, assess, and govern every agent - human-built or vendor-supplied - across your enterprise." – Credo AI

Organizations using Credo AI report significant efficiency gains, including a 60% reduction in manual effort, 30–50% shorter governance cycles, 50% faster workflow adoption, and a threefold increase in engagement among legal, risk, and data teams.

This risk-focused approach feeds directly into Credo AI's dynamic regulatory tracking capabilities.

Regulatory Tracking and Updates

Credo AI uses Policy Packs to monitor and encode global regulations into actionable, standardized assessment requirements. These packs translate complex legal frameworks - such as the EU AI Act, NIST AI RMF, ISO 42001, and NYC Local Law 144 - into technical and process guidelines that organizations can implement. For example, in June 2024, a human resources startup utilized Credo AI Policy Packs to comply with New York City's Local Law 144 by conducting bias audits on AI-driven recruiting tools and generating transparency reports. That same month, a global reinsurance company used the platform to create standardized algorithmic bias reports, simplifying its compliance processes.

"Credo AI Policy Packs encode regulations, laws, standards, guidelines, best practices, and an individual company's proprietary policies into standardized assessment requirements and report templates." – OECD.AI

The platform integrates seamlessly with existing MLOps and data tools, automatically identifying AI systems requiring governance. It delivers real-time updates and governance artifacts as data evolves. Automated alerts and dashboards notify stakeholders when systems deviate from established policies or face new compliance issues, ensuring continuous alignment with global standards and claiming 100% audit readiness.

Pricing Tiers and Scalability for Enterprises

Credo AI provides three deployment options tailored to enterprise needs:

- Public Cloud: Accessible via the Internet, offering speed and scalability.

- Private Cloud: Hosted on private infrastructure for organizations needing tighter control.

- Self-Hosted: Keeps metadata on-premises, suitable for air-gapped or highly secure environments.

The platform is designed to grow with organizations, from initial pilot programs to full-scale enterprise adoption. Pricing details are typically customized and provided through direct consultation.

4. Lumenova AI

Lumenova AI takes a proactive approach to managing risks for both traditional and generative AI systems. Designed for regulated industries like banking, healthcare, insurance, and HR recruitment, it evaluates AI models using 200+ metrics to identify gaps in fairness, bias, security, and performance across the entire AI lifecycle.

Real-Time Alerts for Compliance Risks

The platform offers continuous monitoring that sends instant alerts when deviations occur, such as model degradation, data integrity issues, or compliance risks. These alerts help organizations address problems before they escalate. Its AI Observability feature gives technical teams real-time insights into system behavior, while risk and compliance teams benefit from shared assessments that ensure smooth oversight. This setup also simplifies debugging for complex AI workflows by enabling immediate tracking of LLM and agent interactions.

Risk Scoring and Prioritization

Lumenova AI assigns a "Trust Score" to AI systems, classifying them as low, medium, or high risk. This score considers factors like data sensitivity, decision impact, regulatory exposure, and model complexity. By doing so, it speeds up deployment by 50% and boosts productivity threefold. The platform’s risk classification integrates with enterprise compliance frameworks, ensuring that low-risk systems avoid unnecessary controls while high-risk deployments receive the governance they need.

Regulatory Tracking and Updates

The platform stays current with global regulations, including the EU AI Act, NIST AI RMF, ISO/IEC 42001, Colorado Senate Bill 24-205, NYC Local Law 144, and SR11-7 (Federal Reserve guidance on model risk management). It offers pre-built compliance modules tailored to U.S. standards, translating complex rules into actionable steps. For example, in 2024, Workday aligned its AI governance practices with the NIST AI RMF, creating a structured framework that bridged legal, product, and Responsible AI teams. This approach also improved their ability to evaluate third-party AI platforms. Lumenova’s evaluation tests, developed with input from data scientists and risk experts, ensure that AI systems meet both performance and ethical standards.

Pricing Tiers and Scalability for Enterprises

Lumenova AI provides flexible deployment options, available as SaaS or on-premise solutions, on a fee-based model. They offer a "Forward Deploy Team", a dedicated group that helps organizations achieve audit readiness quickly. Pricing is tailored to enterprise requirements and determined through consultation. The platform supports every stage of the AI lifecycle, from ideation and validation to deployment and eventual decommissioning. A centralized AI Inventory ensures an auditable record of all AI systems within an organization.

5. Xapien

Xapien simplifies reputational due diligence by scanning millions of publicly accessible data sources across various languages and jurisdictions. In just 10 minutes, it produces detailed research reports, enabling organizations to perform compliance checks at what the company describes as a "commercial pace" - perfect for the fast-moving nature of today's business world. This efficiency supports Xapien's advanced tools for risk alerting and verification.

Real-Time Alerts for Compliance Risks

The platform actively monitors risks related to Anti-Money Laundering (AML), third-party relationships, and donor vulnerabilities. It does this by analyzing the entire indexed internet alongside any provided datasets. Using Natural Language Processing (NLP), Xapien distinguishes between individuals with similar names, minimizing false positives that could otherwise misidentify legitimate stakeholders. Risks are flagged immediately within clear, shareable reports, empowering teams to act on critical insights in minutes rather than waiting for traditional, time-consuming reviews.

Risk Scoring and Prioritization

While Xapien doesn't rely on numerical risk scores, it identifies and flags risks by cross-referencing regulatory, legal, and corporate databases. With internet users generating an estimated 2.5 quintillion bytes of data daily, manually analyzing risks is no longer practical. Xapien automates the tedious process of data collection and verification, freeing up human analysts to focus on making strategic decisions rather than sifting through endless data.

"Xapien does the heavy lifting work for you so that you can make better-informed decisions on your risk management and organisation's growth, faster." - Xapien

Pricing Tiers and Scalability for Enterprises

To help businesses evaluate how it fits into their operations, Xapien provides personalized 30-minute demos. By automating data gathering and reporting, the platform enhances the efficiency of manual research teams. It integrates LinkedIn data with regulatory, legal, and criminal database searches to create comprehensive subject profiles, making it a scalable solution for enterprises of all sizes.

6. Regology

Regology simplifies compliance management with its Smart Law Library™, which houses over 16 million laws spanning 135+ jurisdictions and updates automatically. Its Regulatory Change Agent monitors more than 10,000 data sources worldwide, identifying and analyzing legal changes across the globe. This AI-powered system claims to cut down compliance research and analysis time by as much as 90%.

Real-Time Alerts for Compliance Risks

Regology tailors compliance alerts to an organization’s specific "legal DNA", customizing its law library to fit unique needs. These alerts can be seamlessly integrated into GRC platforms like ServiceNow, Archer, and LogicGate using APIs. The system also automatically highlights document changes, eliminating the need for manual comparisons by showing exactly what has been updated in regulatory texts. Industries such as banking, cryptocurrency, gaming, technology, healthcare, manufacturing, and energy have all benefited from these real-time alerts. This functionality ensures that organizations can act swiftly by prioritizing the most critical compliance risks.

Risk Scoring and Prioritization

Regology’s workflows go beyond alerts by scoring and prioritizing legal changes based on their direct impact on operational risks. These workflows assess how new regulations affect an organization’s operations, policies, and risk landscape. For those using the Enterprise plan, dedicated risk management modules map specific risks to regulatory clauses, creating a clear and traceable connection from the law to the associated risk and its controls.

Regulatory Tracking and Updates

Expanding on its alert system, Regology’s Horizon Scanning feature provides early insights into evolving compliance requirements. It tracks legislation from its introduction through to enactment, offering organizations a head start on upcoming obligations. The platform asserts its ability to identify 100% of applicable laws for a user’s profile. With continuous synchronization across GRC systems, any updates to authoritative documents or compliance obligations are instantly reflected throughout the enterprise’s compliance framework.

Pricing Tiers and Scalability for Enterprises

Regology offers three pricing options to cater to different organizational needs. The free Reggi plan provides individual access to the AI assistant. The Professional plan, priced at $1,700 per user per month with a three-year contract, covers U.S. Federal laws and all 50 states. For global jurisdictions and full GRC integrations, the Enterprise plan is available with custom pricing. The platform is designed to scale, making it a fit for both startups and Fortune 500 companies.

"Whether you're a Fortune 500, a startup, or somewhere in between, select the plan that meets your organization's compliance needs." - Regology

7. Mitratech

Mitratech uses AI-driven predictive analytics and natural language processing (NLP) to analyze documents for keywords, relevance, and timelines, delivering concise binary or match summaries. Its Ask ARIES conversational AI assistant, built on billions of events and over two decades of industry experience, offers expert insights into risk management frameworks like NIST, ISO, and SOC 2. Additionally, its sentiment analysis feature streamlines discussions around evidence and tasks, cutting review times while improving precision.

Real-Time Alerts for Compliance Risks

Mitratech goes beyond scanning capabilities by offering real-time, actionable alerts. The platform constantly tracks regulatory updates and automatically triggers alerts, evidence capture, and escalation workflows when control failures, exceptions, or risk thresholds are detected. Its machine learning-powered outlier detection identifies anomalies across assessments. This feature is especially critical, as 40% of compliance leaders report that between 11% and 40% of their third-party vendors are classified as high-risk.

Risk Scoring and Prioritization

The Alyne platform from Mitratech includes a simulation engine that quantifies risks both financially and numerically. It generates materiality and complexity scores for AI applications and third-party vendors while providing residual risk scores to highlight risks that remain after controls are applied [46,47]. These tools have led to notable efficiency improvements; for instance, one organization reduced the time required for matter creation and approval by 90%, cutting the process from three weeks to just one or two days.

"What really stands out with Mitratech is that we're not locked into someone else's templates - we're in the driver's seat. From governance to assessments, risk to remediation, everything lives in one platform we can shape to fit our own processes."

– Jens Wonnberger, Chief Information Security Officer, MANN+HUMMEL

Regulatory Tracking and Updates

To ensure continuous compliance, Mitratech integrates regulatory tracking with internal controls. It maintains an extensive library covering over 21 global regulations, including GDPR, SOX, ISO standards, and HIPAA. AI-powered mapping links these regulations to internal control libraries and evidence repositories [48,51]. When regulatory changes occur, the system automatically updates and prompts reviews of internal documents to maintain compliance. With over 1,500 pre-built templates aligned to various regulations and controls, businesses can establish a comprehensive operational risk inventory in as little as six weeks [47,48,51].

Pricing Tiers and Scalability for Enterprises

Mitratech offers custom, quote-based pricing to meet the unique needs and scale of each organization, often supported by AI consulting services. Its cloud-native, no-code platform can seamlessly scale from mid-sized teams to global enterprises without requiring IT support. Organizations have reported up to 60% cost savings by replacing manual risk mitigation efforts with the Alyne platform. This flexible pricing model and scalable design make Mitratech an appealing choice for enterprises seeking real-time risk assessment tools. The platform's effectiveness has earned it recognition as a Leader in the SPARK Matrix for Vendor Risk Management for four consecutive years [41,47].

8. Onfido

Onfido, now part of Entrust, uses over 10,000 micro-models to spot fraud by analyzing document features like color, shape, and texture. This targeted approach uncovers up to 50% more fraudulent documents compared to broader models. Impressively, 95% of biometric verifications are processed in less than 10 seconds, helping organizations cut down manual review backlogs without sacrificing accuracy. This combination of speed and precision ensures dependable identity verification.

Real-Time Alerts for Compliance Risks

Onfido's Workflow Studio offers a no-code, drag-and-drop tool for building verification workflows and automating compliance responses. The platform flags potential issues in real time with fraud signals such as "Repeat Attempts" and "Known Faces". It also incorporates device intelligence to track geolocation, network data, and emulator use, identifying suspicious behavior without disrupting the user experience. For instance, Chipper Cash reduced customer onboarding time by 35% after adopting Onfido's AI-driven automation.

Risk Scoring and Prioritization

Onfido's Atlas AI engine takes fraud detection further by refining risk evaluations. Backed by 12 years of research, the engine uses over 10,000 specialized models to deliver detailed risk scores for document authenticity and biometric matches. Workflow Studio also provides a complete audit trail for verification workflows, meeting record-keeping requirements. Organizations using Onfido's efficient KYC process have doubled customer acquisition rates and sped up onboarding by as much as 80%.

Regulatory Tracking and Updates

The platform simplifies compliance with regional regulations like FINTRAC, BNM, BSP, and the FCA. It meets global standards such as ETSI TS 119 461 and ETSI EN 319 401 certifications, is eIDAS Regulation EU 910/2014 compliant, and holds NIST IAL2 Remote Identity Proofing certification. Onfido is also recognized under the UK Government's Digital Identity and Attributes Trust Framework (UKDIATF) for High (H1A) and Medium (M1A) confidence profiles. Additionally, it is ISO 27001 Certified, SOC 2 Type II compliant, and has earned recognition from both Gartner and CogX for its efforts in reducing algorithmic bias.

"Onfido (now part of Entrust) set the gold standard in terms of client onboarding. Acting as a true partner, we felt supported with best practices and knowledge-sharing."

– Peter Lu, Credit & Lending Product Lead, KOHO

Pricing Tiers and Scalability for Enterprises

Onfido provides customized pricing through consultations. Its AI-powered automation handles high volumes effortlessly, maintaining consistent processing speeds whether onboarding ten users or ten thousand. Designed for businesses operating across multiple regulatory regions like the EU, UK, and US, the platform's "one provider, multiple markets" model offers a cost-efficient solution. Integration is straightforward, with a developer-friendly setup enabling businesses to go live in as little as a week. This flexibility and scalability make Onfido a strong choice for real-time compliance and risk management.

9. ComplyAdvantage

ComplyAdvantage takes real-time compliance solutions to the next level, focusing on financial transaction risks and real-time sanctions monitoring. Unlike older platforms that cast a wide net with general compliance alerts and risk scoring, this system hones in on the details that matter most.

By leveraging machine learning and expert rules, ComplyAdvantage can process up to 100 transactions per second with response times under a second. It continuously screens customers and entities against global databases, issuing alerts whenever risk profiles change. You can tailor the platform to your needs with customizable rules for data checks, velocity tracking, behavioral analysis, and AML/CTF pattern detection. It also keeps tabs on sanctions, watchlists, Politically Exposed Persons (PEPs), their Relatives and Close Associates (RCAs), and adverse media using natural language processing (NLP) to analyze global news sources.

Real-Time Alerts for Compliance Risks

The Smart Alerts feature uses AI to rank and group suspicious activities based on their risk levels, ensuring high-risk cases get top priority [55, 56]. This system cuts false positives by as much as 70%. Additionally, its Agentic AI automation handles low-risk alerts and enriches cases with external data before they even reach an analyst’s desk.

"ComplyAdvantage has saved our analysts about 50% of the time they previously spent on transaction monitoring. The system has helped us dramatically reduce our false positives, and has also given us the ability to adjust rules in real-time to fit what we need."

– Vice President of Legal and Chief Compliance Officer, PayNearMe

Risk Scoring and Prioritization

ComplyAdvantage employs dynamic risk scoring, blending static data like geographic and demographic details with real-time screening results from sanctions, PEPs, and adverse media [56, 58]. This approach uses probabilistic models to account for factors like name commonness, gender matching, and transliteration. As a result, it automates the remediation of 65–85% of profiles and improves Level 1 analyst productivity by 85–90% [56, 58]. Compliance teams have reported saving 80% of the time they used to spend creating and updating risk scenarios.

Regulatory Tracking and Updates

The platform keeps you updated with real-time changes, refreshing sanctions lists within minutes of official updates. It maps its data to predicate crimes outlined by FinCEN, FATF, and the EU (6AMLD) and uses AI-driven optimization to refine detection as financial crime tactics evolve [56, 60]. On top of that, it meets stringent security and data protection standards, being SOC 2 Type II and ISO 27001 certified, and fully compliant with GDPR.

"The system is straightforward to use, and the data is live. We're screening in real-time, and that gets us closer to our goal of being the best compliance team in the business."

– Global Head of Financial Investigations and Monitoring, TransferMate

These features make ComplyAdvantage a scalable solution that fits businesses of all sizes.

Pricing Tiers and Scalability for Enterprises

ComplyAdvantage offers a Starter Plan at $99.99 per month, which covers up to 2,000 monitored entities - ideal for smaller businesses. For larger organizations, the Enterprise Plan includes unlimited usage and full access to the compliance suite, with pricing available upon request. Deployment is quick, often taking less than two weeks, and the platform integrates seamlessly with existing systems via RESTful APIs, batch processing, or SFTP data transfers [55, 58].

10. LogicGate

LogicGate offers a no-code compliance risk assessment platform, making it accessible for businesses without the need for technical developers. Its Risk Cloud uses a flexible graph database to connect siloed data across an enterprise, giving organizations clear insight into risk interdependencies. With over 40 pre-built applications, companies can start with the tools they need and expand as their governance, risk, and compliance (GRC) programs grow [61, 62]. This approach emphasizes real-time, data-driven solutions for managing compliance risks.

The platform has delivered impressive results for its users. Businesses report an 80% reduction in audit completion time and a 98% decrease in audit findings. Financially, organizations have saved over $250,000 annually through automation while improving task efficiencies by 25% [61, 62]. LogicGate has automated more than 20,000 workflows globally, showcasing its ability to support enterprise-scale operations [61, 62].

Real-Time Alerts for Compliance Risks

LogicGate's Workflow Automation ensures stakeholders are notified about specific events or deadlines, while real-time dashboards offer role-based visibility into key metrics and program performance [61, 63]. Its continuous monitoring system flags issues like data privacy breaches and algorithmic bias immediately [64, 65].

A standout feature is Spark AI's automated gap analysis, which visually compares your current compliance coverage against new or updated frameworks in real time. It even auto-generates corrective action plans, streamlining the process.

Beyond alerts, LogicGate provides tools to quantify risks, enabling more strategic decision-making.

Risk Scoring and Prioritization

The Risk Cloud Quantify® feature uses Monte Carlo simulations and the Open FAIR™ Model to translate compliance risks into dollar values, helping businesses prioritize investments effectively [62, 63]. The Issues Management application applies priority scoring to close compliance gaps quickly and identify emerging risks. Spark AI further enhances gap analysis by cross-mapping controls across different frameworks for greater accuracy.

"The value drive for an organization is to have a centralized data repository that can meet all its different challenges – whether it's third-party risk, policy management, controls management, or enterprise risk management. And LogicGate does that."

– Matt Kunkel, CEO and Co-Founder, LogicGate

Organizations using LogicGate's AI Governance tools report spending 25% less time on risk identification and achieving 77% time savings during vendor onboarding. The platform supports over 25 security and privacy frameworks, including NIST AI RMF, ISO 42001, SOC 2, and the EU AI Act [65, 64].

Regulatory Tracking and Updates

LogicGate simplifies regulatory monitoring by integrating with third-party providers like CUBE, Ascent, and the Unified Compliance Framework (UCF). It tracks changes across major regulatory bodies such as the SEC, FINRA, and GDPR [62, 64]. Its "horizon scanning" feature links regulatory updates directly to your internal obligations, eliminating the need for manual tracking. Real-time board-level reporting dashboards provide data-driven insights into program performance and regulatory compliance.

These features make LogicGate a powerful compliance tool, with pricing designed to scale alongside your business needs.

Pricing Tiers and Scalability for Enterprises

LogicGate follows a "Request a Demo" approach for pricing, offering customized quotes based on an organization's specific requirements [61, 62]. The Operational Risk Management Suite includes four Power User licenses for administrators, unlimited access for other users, and one free integration with top partners like Workday, DocuSign, NetSuite, or OpenAI. Additionally, Spark AI features are available across the platform at no extra cost. This flexible pricing model ensures the platform can grow with your compliance needs.

Recognized as a "Leader" in the Gartner® Magic Quadrant™ for GRC Tools and The Forrester Wave™: Governance, Risk, and Compliance Platforms, Q4 2023, LogicGate’s user experience has been described as "second to none" [61, 62]. G2 has also named LogicGate a leader in Enterprise Risk Management for 24 consecutive quarters as of Summer 2025.

Feature Comparison Table

Here's a quick look at the standout compliance features offered by the top 10 AI tools:

| Tool | Key Feature |

|---|---|

| Vanta | Conducts over 1,200 automated hourly tests, integrates with 400+ systems, and supports 35+ compliance frameworks, including AI standards. |

| Compliance.ai | Analyzes 200,000 pages of U.S. federal regulations, provides unlimited customizable alerts, and reduces document review time by 97%. |

| Credo AI | Offers a centralized AI registry with risk scoring, Policy Packs for global regulations, and a 60% reduction in manual governance tasks. |

| Lumenova AI | Assesses AI models using 200+ metrics, assigns Trust Scores for risk classification, and supports the EU AI Act and NIST AI RMF. |

| Xapien | Produces detailed due diligence reports in just 10 minutes, scans millions of public data sources, and leverages NLP to reduce false positives. |

| Regology | Features a Smart Law Library with 16+ million laws across 135+ jurisdictions and monitors 10,000+ data sources for regulatory changes. |

| Mitratech | Uses AI-powered predictive analytics, a simulation engine for financial risk quantification, and includes 1,500+ pre-built regulatory templates. |

| Onfido | Employs 10,000+ micro-models for fraud detection, processes 95% of verifications in under 10 seconds, and uses the Atlas AI engine for risk scoring. |

| ComplyAdvantage | Handles 100 transactions per second, reduces false positives by 70%, and offers real-time sanctions and PEP screening. |

| LogicGate | Provides a no-code platform with 40+ pre-built applications, Risk Cloud Quantify® for dollar-value risk translation, and Spark AI for automated gap analysis. |

Before making a decision, ensure you verify the specific functionalities, pricing, and scalability of each tool. Refer to the detailed profiles above for a deeper understanding of their capabilities.

Conclusion

The ten AI compliance tools highlighted here represent a major shift in how organizations approach risk management. Instead of relying on reactive, checklist-driven methods, these tools enable proactive and continuous compliance strategies. By automating labor-intensive tasks like evidence collection, document analysis, and regulatory monitoring, these platforms allow compliance teams to focus on more strategic priorities. For instance, AI-driven GRC platforms can cut manual workloads by as much as 70% while achieving an impressive 99.8% accuracy in identifying compliance gaps.

As detailed earlier, the ability to consistently monitor regulatory changes combined with automated risk scoring underpins these impressive outcomes. Many companies now maintain audit readiness through real-time evidence collection. Some AI-native platforms have even reduced false positives in sanctions compliance by 99%, all while monitoring regulatory updates around the clock to anticipate risks before they arise.

"AI informs and suggests while your judgment drives final decisions, ensuring accuracy and accountability." - NAVEX

Before adopting any tool, it’s crucial to assess your specific compliance needs. Start by identifying the regulatory frameworks relevant to your industry - whether it’s HIPAA for healthcare, AML requirements for financial services, or the EU AI Act for AI system deployments. Evaluate your current technology stack to ensure smooth integration, and prioritize tools that provide transparent, explainable outputs rather than opaque "black box" decisions. Many organizations find it useful to start small, such as focusing on a single risk domain like third-party screening, before scaling up to enterprise-wide GRC.

Ultimately, the best AI compliance tool for your organization will depend on factors like your regulatory landscape, team size, and process maturity. Whether you need advanced automated testing, fast document review, or customizable no-code workflows, choosing the right tool will position your team to navigate compliance challenges with confidence.

FAQs

How can AI compliance tools enhance risk management for businesses?

AI compliance tools make managing risk much easier by automating tedious tasks, cutting down on human errors, and offering real-time monitoring and analytics. These tools help businesses spot, evaluate, and tackle potential risks more swiftly, streamlining compliance efforts.

With AI in the mix, organizations can make smarter decisions, save valuable time, and use their resources more efficiently. This approach helps teams stay proactive with compliance while keeping operational risks to a minimum.

What should I look for when selecting an AI compliance tool for my business?

When selecting an AI compliance tool, it’s essential to focus on features like real-time risk monitoring and automated alerts. These capabilities allow you to quickly identify and address compliance issues as they arise. Tools that offer instant insights and generate audit-ready reports can help your organization keep up with regulatory demands and avoid hefty penalties.

It’s also important to assess factors like customizability, integration options, and regulatory coverage. The most effective tools should align with your workflows, seamlessly integrate with your existing systems, and support critical regulations such as GDPR, CCPA, and SOX. Additionally, prioritize solutions with strong security certifications, such as SOC 2 or ISO 27001, to ensure your data remains protected.

Lastly, consider the tool’s scalability, user-friendliness, and vendor support. A reliable compliance tool should be able to grow alongside your business, offer an intuitive interface that’s easy for your team to navigate, and provide dependable customer support. If you’re unsure where to start, NAITIVE AI Consulting Agency offers expert guidance to help you design and implement a compliance strategy tailored to your organization’s specific needs.

Can AI compliance tools help businesses meet regulations like GDPR or the EU AI Act?

Yes, AI compliance tools are a game-changer for businesses dealing with intricate regulatory frameworks like GDPR and the EU AI Act. These tools automate critical tasks such as compliance monitoring, risk assessments, and detailed report generation, making it easier for organizations to keep up with evolving regulations.

By incorporating AI, companies can cut down on manual work, lower the chances of errors, and meet legal obligations with greater efficiency. This is especially helpful for businesses managing large-scale operations or handling sensitive data across various regions.